In an analysis of over 50 US hospitals, signing bonuses created about $2,800 worth of retention value while costing $10,000+ per employee

What the data says

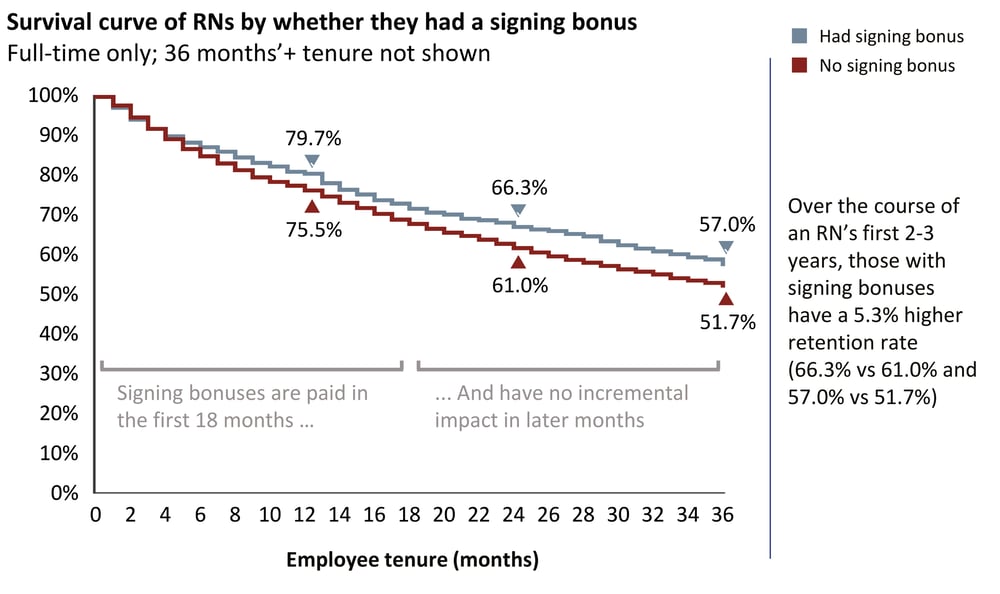

During the pandemic, many health systems launched signing bonuses for RNs or expanded their existing use. Those that consistently use RN signing bonuses see minor improvements in turnover during the first 18 to 24 months.

Organizations that consistently use signing bonuses average 66.3% net RN retention rates (for each RN receiving the signing bonus) by the end of the 24th month; those that do not use signing bonuses see a 61.0% adjusted net RN retention rate (terms are defined at the end of this article).

The difference between those two values means that each RN who received a signing bonus was 5.3% more likely to be retained by the end of the second year; this equates to about $2,800 in value (detailed in the “What It Means” section below).

With RN signing bonuses currently reaching $15,000 and higher, a business case is needed to support them that goes beyond an improvement in retention.

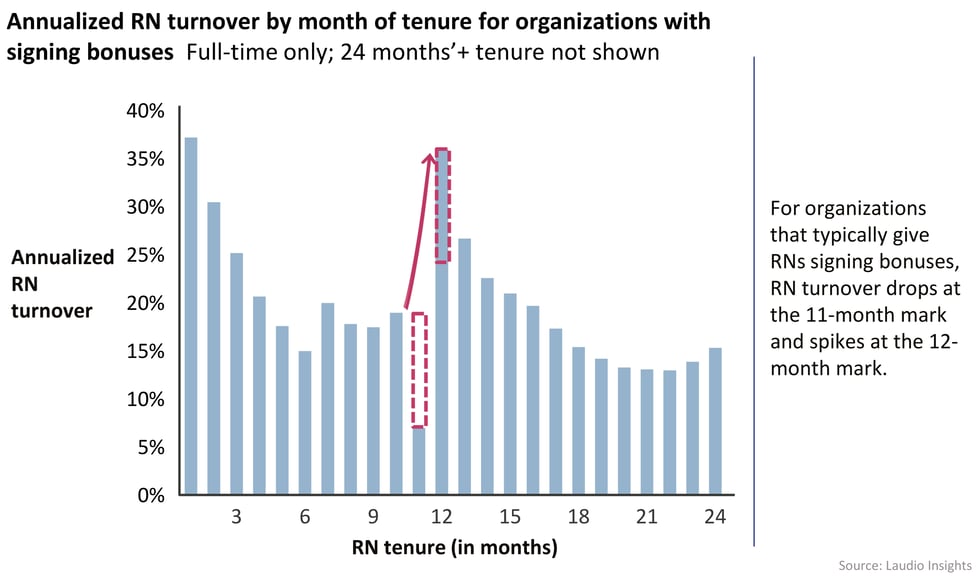

One additional impact of signing bonuses is a noteworthy and predictable spike in churn at the 12th month, which can compound staffing challenges. Very few RNs leave at the 11th month; instead, they leave at the end of the 12th month, after the 12-month bonus milestone is paid out (as shown below). Such a 12-month spike does not exist for organizations that don’t use signing bonuses.

What it means

Signing bonuses are used for two primary reasons: to attract new hires and to increase retention. They may be necessary for the former, but have limited effectiveness for the latter.

Signing bonuses are used to “win the battle” for new RN hires when the RNs may have competing offers from other organizations in competitive markets. Are they the best option?

- Signing bonuses are frequently used to fill roles in competitive markets and in harder-to-fill specialties. Bonus size is often commensurate with both the salary level and the level of difficulty in filling the role.

- After receiving a job offer, candidates may wait to see if a better offer is available before accepting; signing bonuses can effectively overcome this hesitation. There are other approaches, though, such as expiring offers or “non-financial” signing bonuses that have expiration dates.

- Signing bonuses can be a successful recruiting tool; however, they are expensive. They may attract culturally mismatched candidates and encourage regular job-hopping within a competitive market, creating negative overall value for the affected organizations.

- RN vacancy rates, an acute challenge in much of the country right now, drive some of the impetus for signing bonuses. In order to develop the opportunity for longevity in a relationship with an RN, the organization first has to get them through the door. However, have other options been tried? Might other options be more effective if filling vacancies is the only goal?

Signing bonuses are used to create longevity for early-tenure RNs in the organization. The data shows that this approach has limited value.

- With an average $52,358 cost per RN turnover event (NSI 2023), a 5.3% retention improvement for an individual RN equates to $2,800 in value; therefore, healthcare systems can justify signing bonuses up to that amount purely on the basis of retention improvement.

What the implications are for healthcare leaders

Executives should consider experimenting with other approaches to improve their recruiting yield in competitive markets.

- In a competitive market, organizations have significantly improved yield from their recruiting pipeline by increasing the speed of the recruiting process itself. If this hasn’t been implemented yet, the impact of making process improvements could replicate the yield added by offering signing bonuses, with the added benefits of major cost reductions and avoidance of mismatched “bonus hoppers.”

- For those looking to implement such improvements, consider these suggestions based on conversations with executives operating in particularly competitive markets:

- Reduce the time from an RN’s initial interest in a role/submitted application to the job offer. Is it a few days or a few weeks currently? Can the organization rebuild the process to reduce the time to 24 hours? Or three days?

- Health systems with the fastest hiring times have typically set up a rotation of “on call” directors and managers for interviews each week. For example, if ten managers handle interviews for roles in ICUs, two of them are “on call” every fifth week. When a candidate becomes available, they prioritize the interview (ideally offering times within the next business day) and are able to approve issuing a job offer. The manager to whom the candidate would report may not meet them prior to the offer; however, the HR team can arrange a meeting with the potential manager shortly afterwards. These meetings are encouragement and get-to-know-you sessions instead of an interview.

- Healthcare systems can also consider non-financial signing bonuses, a creative approach inspired by leading organizations outside of healthcare. For example, if an applicant accepts the offer within five business days, they could be invited to a special lunch, given a campus tour, and given a budget to use on learning and conference events in their first 18 months.

Signing bonuses, as they are typically structured, don’t create meaningful longevity; other approaches may be better.

- Most signing bonuses pay increments at the six-, 12-, and/or 18-month marks. The intent is to avoid paying the full sum at 12 months and see a corresponding exodus immediately afterwards. Organizations that maintain signing bonuses should consider removing the 12-month payment milestone altogether, as it reinforces the typical new grad RN pattern of leaving after accumulating a year’s experience.

- Separating any bonus payout from the 12-month mark by even three or four months may remove the long-standing tradition of RNs seeking new external opportunities after their first year. Delaying the bonus payment also gives the organization time to create and communicate internal growth opportunities.

- One longer-lasting alternative to signing bonuses is to offer higher base salaries. If the cost of the bonus is spread out over the employee’s first 24 monthly paychecks, the higher salary may appeal to candidates who are looking for longer commitments. If a candidate stays for four years instead of two, the higher salary will indeed cost more than a one-time bonus, but the payment of an additional bonus and the value of a longer-tenure team member will far outweigh that incremental cost.

- Another option is to create milestones in the RN’s career that go beyond bonuses. For example, every RN at 18 months can join a small lunch with the CEO where they can ask questions about the organization, its goals, and its future. If organizations are strategic and intentional about internal development opportunities, the loss of team members at points of early tenure will shift.

- Finally, manager actions such as New Hire Check-Ins have a proven impact on early tenure retention. Instead of signing bonuses, consider investing in managers and increasing their ability to spend time connecting with their early-tenure team members.

Data definition

- Adjusted net RN retention rate

- Because the two cohorts of organizations in the main chart (“had signing bonus” and “no signing bonus”) have many contrasting attributes (e.g., one of the cohorts may have more facilities in highly competitive markets), an adjustment was made to the “no signing bonus” survival curve as an attempt to remove these differences.

Note that signing bonuses have no net new impact between 24 and 36 months of tenure as they have been paid by this point. - The “has signing bonus” cohort has a net RN retention rate of 90.6% during this 12-month window.

- The unadjusted “no signing bonus” cohort has a net RN retention rate of 89.3% during this 12-month window. Therefore, each month of the unadjusted “no signing bonus” cohort was multiplied by 1.0037 to create an adjusted “no signing bonus” cohort that had a matching net RN retention rate of 90.6% between 24 and 36 months of tenure.

- By aligning the net retention rates during a period that was unaffected by signing bonuses, the difference observed during the affected period allows the isolated impact to be measured more clearly.

- Note that this is not a perfect approach: if the “signing bonus” cohort is also investing in more robust RN residency programs for new grads or conducting other initiatives that could impact early tenure retention, that would bias the impact. However, it is more likely that organizations offering signing bonuses do so because of the competitive nature of their markets, and thus are doing at least as much in other retention-boosting areas as non-signing bonuses organizations. Therefore, this establishes the calculation of $2,800 worth of retention value as the maximum positive impact of a signing bonus.

Cost of RN turnover: NSI Nursing Solutions, Inc., 2023 NSI National Health Care Retention & RN Staffing Report - Because the two cohorts of organizations in the main chart (“had signing bonus” and “no signing bonus”) have many contrasting attributes (e.g., one of the cohorts may have more facilities in highly competitive markets), an adjustment was made to the “no signing bonus” survival curve as an attempt to remove these differences.

Written by

Tim Darling

President of Laudio Insights

Tim Darling is a co-founder and President, Laudio Insights. With over 20 years of experience in healthcare technology, Tim has a real passion for using data and analytics to serve the challenges facing healthcare organizations. Prior to Laudio, Tim was on the leadership team of a healthcare education analytics company and he spent seven years as a consultant at McKinsey & Company. He has an MBA from Carnegie Mellon and BS degrees in Mathematics and Computer Science from the University of Maryland, College Park.